TfL have today issued a press release to the trade, announcing the intended changes to the regulation regarding the mandating of credit card payment acceptance and the conditions attached.

After much ado about the customer surcharge being scrapped, we were originally informed that the driver would be responsible for any payment processing charge.

We were also told that in the interests of fairness, any charge would be capped at 3%. We were then told this would be non negotiable on our part.

But it seems it wasn’t non negotiable on the part of third party TfL partners who have said they can’t survive making a living off the backs of the Taxi trade with just a 3% charge.

And so our regulator scrapped the cap.

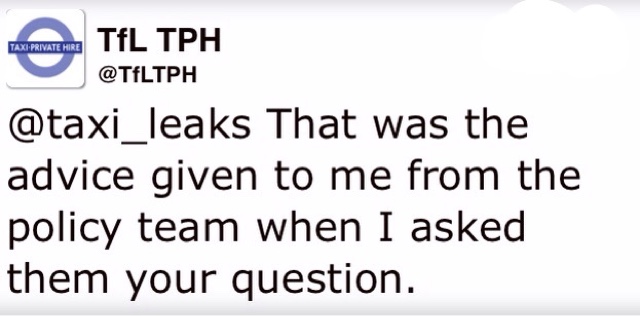

I recently asked TfL on the open forum of their Twitter Account if the cap had been scrapped….a simple question requiring a yes or no…and was given this:

Credit and debit card and contactless payments to be accepted in all London taxis

Credit and debit card mandate

All London taxis will be required to accept card payments, including contactless, from 3 October 2016, making travelling by taxi easier and a more attractive option for passengers.

The acceptance of card and contactless payments was the subject of a Transport for London (TfL) consultation at the end of last year that found 86 per cent of respondents backed card acceptance, with 68 per cent agreeing that passengers should also be able to pay using contactless payments.

TfL also committed to work with the card payment industry to link card payment devices directly to the taximeter in future.

The changes in relation to card payments are as follows:

2 April 2016

- The existing card payment surcharge of up to 10% or £1, whichever is greater, will be removed from 2 April 2016. After this date taxi drivers must not charge passengers a surcharge when accepting credit or debit card payments

- To help taxi drivers recoup the costs to them of accepting card payments, an additional 20 pence will be added to the flagfall of all taxi journeys making the new flagfall for 2016/17 £2.60

Any existing signage that advises passengers there is a card payment surcharge must be removed

3 October 2016

- All taxis must be fitted with a TfL approved card payment system within the passenger compartment

- All taxi drivers must accept credit and debit card payments (VISA and MasterCard as a minimum)

- All taxi drivers must accept contactless, Chip and PIN and magnetic swipe. Where a taxi is not fitted with an approved TfL card payment system or found to have a broken or faulty system this may have licensing implications.

TfL approved card payment systems

The current list of TfL approved card payment devices and systems are laid out in the table below:

TfL is working with card payment systems suppliers to ensure they are prepared to meet the changes, which include the new requirement that a card payment terminal must be fitted within the passenger compartment. All TfL approved card payment systems must continue to have the facility to print card transaction receipts in accordance with the following:

>content.tfl.gov.uk/guidelines-for-electronic-payment-devices-in-taxis-and-phvs.pdf<

TfL is designing signage to indicate acceptance of card payments and more information will follow in due course.

Helen Chapman

General Manager, Taxi and Private Hire

12 February 2016